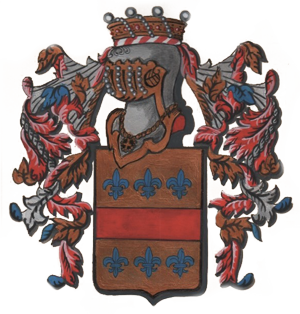

Manfred (Fred) Reinertz Baron Barriera

Manfred (Fred) Reinertz Baron Barriera possesses a distinguished academic and professional background that highlights both his expertise and his commitment to lifelong learning. He earned a PhD from Washington University (WashU), establishing a solid foundation in advanced research and scholarship. In addition, he holds a Quantitative Finance Certificate from NYU Stern, which reflects his analytical skills and specialization in finance.

Baron Barriera also obtained a Diploma in EU Banking & Financial Law from IUIL, demonstrating his in-depth knowledge of European financial regulations. Complementing these credentials, he completed an MBA at the Catholic University Louvain (UCL), further enhancing his business acumen and management capabilities. His academic journey began with a Bachelor of Commerce (B. Com) from the University of Grenoble Alpes (UGA), providing him with a robust scientific base for his subsequent studies and professional career.

Baron Barriera is actively involved in esteemed social circles, underscoring his international presence and respect for tradition. He is a member of the Accademia Araldica Nobiliare Italiana, an affiliation that reflects his connection to Italian nobility. On a global scale, he maintains non-resident, offshore memberships in several prestigious Singaporean clubs, such as the Singapore Polo Club, the Singapore Cricket Club, and the Tanglin Club Singapore. These memberships signify his cosmopolitan relationships and appreciation for established customs.

Additionally, Baron Barriera has a historical association with the Singapore Town Club, a notable institution founded in 1861 during the British Straits Settlements period. Although the club today has faded away in oblivion, this association highlights its his ties to longstanding social traditions and heritage.

Baron Barriera has received numerous honors that recognize his service, heritage, and esteemed reputation. Among his distinctions is the Pilgrim Shell of the Military and Hospitaller Order of Saint Lazarus of Jerusalem, which marks his honor within this historic order. He has also been awarded the titles of Knight Grand Gross of Justice, jure sanguinis with collar, and Knight Grand Cross of Merit, representing both hereditary and merit-based achievements.

His leadership is further demonstrated by his role as bailiff preceptor of the Order in the Grand Duchy of Luxembourg, evidencing his ongoing commitment and influential position within the order.

In his professional capacity, Baron Barriera operated as a project-based, freelance Senior Consultant in the financial sector. His career was marked by flexibility and deep expertise, enabling him to have made valuable contributions to a variety of projects. He currently holds emeritus status, reflecting his extensive experience and enduring influence within his field.

Bio

Baron Manfred Reinertz Barriera has established a distinguished reputation within the financial sector, demonstrating exceptional leadership as a paralegal, supervisory, and regulatory adviser. His professional journey began with a solid foundation in corporate and investment banking, concentrating his work in the ASEAN region and Hong Kong. During his tenure in Singapore, Baron Reinertz Barriera was responsible for overseeing operations across Asia, where he managed cross-border activities and developed a comprehensive understanding of the region’s financial landscape. Driven by a desire to further enhance his expertise, he subsequently relocated to London, where he continued to deepen his experience and knowledge within the global financial industry.

Building on his experiences in Asia and London, Baron Reinertz Barriera later developed specialized expertise as an ancillary consultant in Luxembourg, a period that coincided with rapid expansion in the investment fund sector. In this capacity, he advised a wide range of clients, including custodian banks, management companies, hedge funds, fund service providers, and central securities depositaries. His responsibilities encompassed numerous supervisory and regulatory advisory roles, where he guided financial institutions through complex regulatory environments and supported their efforts to maintain compliance and competitiveness.

Throughout his distinguished career, Baron Reinertz Barriera has also served as a registered EU Financial Services expert. In this capacity, he participated in EU Technical Assistance projects on a global scale, collaborating closely with central banks and supervisory and regulatory authorities in the financial sector worldwide. His work placed particular emphasis on the implementation of Basel III and post-crisis regulatory reforms. Additionally, he contributed to discussions on monetary policy matters, further enhancing his stature as a sought-after expert for EU technical assistance projects and framework contracts.

Currently recognized as an emeritus, Baron Reinertz Barriera continues to provide specialized advisory services in the areas of private equity, venture capital, and wealth management. He remains active in the academic community, regularly lecturing at the Financial Center in Luxembourg and participating in international events, where he addresses critical issues related to corporate governance in the financial sector. In addition to his advisory and academic roles, he serves as a Legal Examiner at the Luxembourg High Courts of Justice, with a specialization in banking and finance matters.

Baron Manfred Reinertz Barriera PhD 2025

Professional Experience

I have developed comprehensive corporate governance guidelines for the Russian Federal Service for Financial Markets. My work also includes authoring Basel II implementation guidelines for the National Bank of the Czech Republic, as well as crafting risk-based Basel II implementation strategies for the National Bank of Slovakia. Furthermore, I contributed to the Basel II implementation guidelines for the National Bank of Moldova (Central Bank).

In Azerbaijan, I proposed a new capital market architecture to the capital markets regulator and authored EU legal approximation guidelines for the capital market law at the Moldova Capital Markets Regulator.

I contributed to the EDF White Book, specifically « Livro Branco sobre Convergência Normativa e Técnica, » focusing on the evaluation of financial services. In Cape Verde, I co-authored a study with the Central Bank on making macro-prudential policy operational and developed public policies to support economic development.

For the EC Brussels Headquarters, I participated in a study regarding the « ad hoc » implementation modus for the new ENPI European Neighborhoods and Partnership Instruments (EuropeAid/119860/C/SV/Multi). As a consultant for the International Bank for Reconstruction and Development, I enhanced regulatory capital calculation in alignment with the EU framework for bank risk capital adequacy (EU directives 2006/48/EC and 2006/49/EC) at the National Bank of Ukraine.

I was a contributor to the European Central Bank/European Systemic Risk Board’s Handbook on operationalizing macro-prudential policy to support economic development. Additionally, I authored a concept paper for an integrated capital market structure in Azerbaijan.

I co-contributed to a legal opinion on EU Directive 2011/61/EU and Delegated Regulation (EU) No 231/2013 on AIFM, and was a contributor to the BIS’s Quarterly Review (June issue) on rating methodologies for banks. I participated in a comparative analysis of major stock exchanges (NYSE, NASDAQ, and LSE) published in an academic journal by MCSER Publishing, Rome, Italy.

As an advisor to the European Commission Directorate-General International Cooperation and Development (DEVCO), I provided quasi-evaluative support for the assessment of the EC’s contribution to World Bank Group Trust Funds and Financial Intermediary Funds. I also co-authored the « Domiciles of Alternative Investment Funds » report with Oliver Wyman.

I analyzed the impact of the EU Capital Requirements Regulation (CRR)—specifically Basel III implementation in the EU—on access to finance for businesses and long-term investments.

I participated in two scheduled missions (ALTUN/CMB/TR2011/0740.26-2/SER/004) aimed at strengthening the Capital Market Board of Turkey. Additionally, I contributed to the « Request for Services no 2014/353575, » focusing on institutional capacity building at the Central Bank of Egypt in banking supervision, e-banking, and financial inclusion.

I provided expert assistance to the SADC Secretariat and EU Delegation on the « Support to the Investment and the Business Environment in the SADC Region, » covering South Africa and Botswana. My work included an analytical assessment of the National Bank of the Republic of Macedonia’s (NBRM) domestic regulatory framework on ICAAP (Basel III).

In collaboration with London Economics (LE) Europe, I co-authored studies on rating and scoring methods for SMEs, including relevant legislation and regulations.

I participated in the final external evaluation of the EC Project LAO/B7-3010/IB/97/0210 Euro-TAL Bank Training Project in Lao PDR (EuropeAid/119860/C/SV7multi) for the Central Bank. Additionally, I developed a financial training plan for the Jordan Securities Commission, focusing on international standards in accounting and auditing.

As a consultant for the International Bank for Reconstruction and Development/Dutch Grant TF 055212 project, I aided the National Bank of Ukraine in developing regulatory and legal frameworks for the implementation of risk-based supervision.

For the Capital Markets Board of Turkey, I prepared a comparison report of Turkish and European Union legislation and regulations applicable to capital requirements for investment firms. In Syria, I provided advice on banking sector reform to the Minister of Finance, the Central Bank, and the Credit and Monetary Council as part of the Banking Sector Support Program II.

For the Central Bank of Kosovo, I conducted a gap analysis on the draft law for micro-finance institutions, non-bank financial institutions, the law on payment systems, and the law on the Central Bank of the Republic of Kosovo.

I advised consultants working with the Palestine Capital Market Authority on establishing a regulatory framework for a stock exchange, with a focus on the separation of Clearing, Depository, and Settlement Center functionalities.

As a Legal Examiner at the Luxembourg High Courts of Justice in banking and finance matters, I issued a memorandum to clarify the meaning of a disclaimer of audit opinion in audit reports, with due consideration of Luxembourg accountancy law.

Contact

Baron Manfred (Fred) Reinertz Barriera PhD

Emails

fred.reinertz@gmail.com

reinertz@pt.lu

frre3153@yahoo.com

fred.reinertzbarriera@outlook.com

Phone

+352 305 895